dependent care fsa limit 2022

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. ARPA Dependent Care FSA Increase Overview.

For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more.

. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000. Double check your employers policies. The Consolidated Appropriations Act 2021 CAA signed into law at the end of 2020 allows employers that sponsor health or dependent care FSAs to permit participants to roll over all unused.

This amount is set by statute and not. Your Money Doesnt Roll Over. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

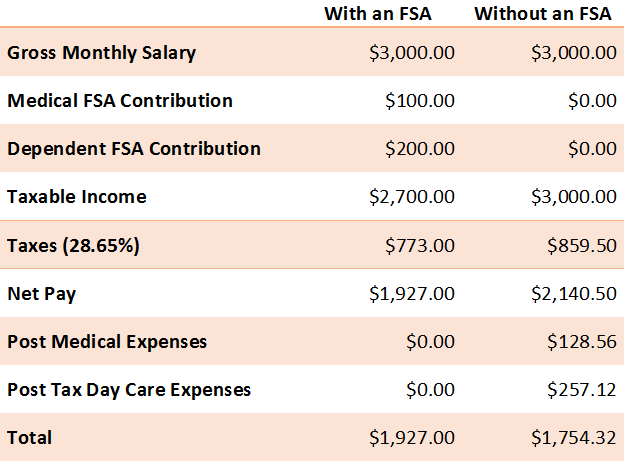

Dependent Care FSA Increase Guidance. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. Adoption Assistance Tax Credit.

For 2022 and beyond the limit will revert to 5000. IRS Tax Tip 2022-33 March 2 2022. Find out if this type of FSA can help you.

Dependent Care FSA. Employers can choose whether to adopt the increase or not. The limit is expected to go back to 5000.

10500 Qualified CommuterParking Benefits. This is an increase of 100 from the 2021. The annual maximum exclusion limit for the 2022 taxable year will revert to the statutory maximum of 5000 2500 for married individuals filing separately.

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals. A handy chart showing 2022 benefit plan limits and thresholds. Many of the rule changes for FSAs in 2020 2021 and 2022 are not mandatory for.

401k plans health savings accounts health and dependent care flexible spending accounts transit benefits and more. The 2022 family coverage HSA contribution limit increases by 100 to 7300. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

Should You Offer A Dependent Care Fsa Business Com

Health Care And Limited Use Fsa Human Resources Northwestern University

A List Of 77 Hsa Eligible Expenses For 2022 Goodrx

How Does A Dependent Care Fsa Dcfsa Work Lively

What Is A Dependent Care Fsa Optum Financial

Employers What You Need To Know About 2022 Benefit Limits

What Is A Limited Purpose Fsa Optum Financial

Flexible Spending Accounts Human Resources

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

What Is A Dependent Care Fsa Optum Financial

What Is A Dependent Care Fsa Optum Financial

How To Use A Dependent Care Fsa When Paying A Nanny

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post